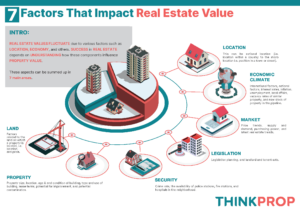

Real estate value is determined by a combination of various factors that influence the demand and supply of the property. In general, there are seven main aspects that affect the value of real estate: location, economy, land, property, security, laws, and market factors.

Understanding these factors is crucial for anyone looking to invest in real estate, as it can help them make informed decisions and maximize their returns. By analyzing these factors, investors can identify properties that are likely to appreciate and generate long-term profits.

Location:

The location of a property is perhaps the most significant factor that affects its value. Properties situated in prime locations with easy access to public transportation, shopping centers, and other amenities tend to have a higher value. The desirability of a location can also be influenced by its proximity to good schools, hospitals, parks, and other attractions. On the other hand, properties located in areas with high crime rates, traffic congestion, and noise pollution tend to have a lower value. The location of a property is a crucial consideration for both buyers and sellers in the real estate market.

Economy:

The state of the local and national economy can impact real estate value. A robust economy with low unemployment rates and a strong GDP typically translates to higher real estate values. In contrast, a struggling economy with high unemployment rates and a weak GDP can lead to a drop in real estate prices.

Other factors that can affect real estate value include interest rates, housing supply and demand, and government policies such as tax incentives for homebuyers. It is important for both buyers and sellers to keep an eye on these economic indicators when making decisions about real estate transactions.

Land:

The land on which a property is built also plays a significant role in determining its value. Factors such as topography, soil quality, and accessibility can impact the land’s value.

For instance, land that is hilly, rocky, or has poor soil quality may not be suitable for building, which can lower its value. On the other hand, land that is easily accessible and has good soil quality can be more valuable as it can support a variety of uses, such as farming or development. Therefore, it is important to consider the land’s characteristics when assessing a property’s value.

Property:

The physical condition of a property, including its age, size, and style, can impact its value. Newer properties or those that have undergone significant renovations or upgrades typically have a higher value. The size of the property is also a critical factor, as larger properties tend to be more expensive than smaller ones.

Security:

The level of security in the area surrounding a property can impact its value. Properties located in safe and secure neighborhoods with low crime rates tend to be more valuable than those in areas with higher crime rates. The presence of security systems such as CCTV cameras, security personnel, and security gates can also increase a property’s value. In addition, properties that have implemented smart home security systems, such as remote monitoring and control of locks, alarms, and cameras, may also be more attractive to potential buyers and command a higher price.

Legislation:

The legal framework surrounding real estate can also impact its value. Regulations such as zoning laws, property taxes, and building codes can affect the value of a property. Changes in legislation, such as the introduction of rent control laws or new environmental regulations, can also have an impact on real estate value. For example, if a property is located in an area with strict zoning laws that limit the type of development allowed, it may decrease its value. Similarly, the introduction of rent control laws may discourage investors from purchasing rental properties, leading to a decrease in their value.

Market factors:

The state of the real estate market can impact the value of a property. A seller’s market with high demand and low supply typically results in higher real estate prices, while a buyer’s market with low demand and high supply can lead to lower prices.

It is important for buyers and sellers to stay informed about the current state of the real estate market in their area in order to make informed decisions. Real estate professionals can provide valuable insights and guidance on navigating market conditions.

Conclusion

The value of a real estate is influenced by a combination of factors, including location, economy, land, property, security, legislation, and market factors. Understanding these factors is critical for investors, developers, and homeowners alike. By staying informed about these factors, real estate stakeholders can make informed decisions that can help maximize the value of their properties.